Embarking on the Journey

When you decide to implement fraud detection software in your insurance company, you’re setting out on a journey filled with both challenges and rewards. Understanding what to expect along the way can help you navigate this process smoothly and achieve the desired outcomes.

The Nature of Investigations

Investigations in the insurance industry can be lengthy, often running for up to 12 months or more. The results of these investigations are only known upon completion, meaning that any savings or benefits from a fraud detection system cannot be fully realized until then. Furthermore, unsuccessful investigations tend to conclude more quickly than successful ones, which can create a misleading impression of the effectiveness of the new system. This sometimes leads to the perception that a new system is not only failing to improve upon previous systems but is less effective.

Managing Expectations

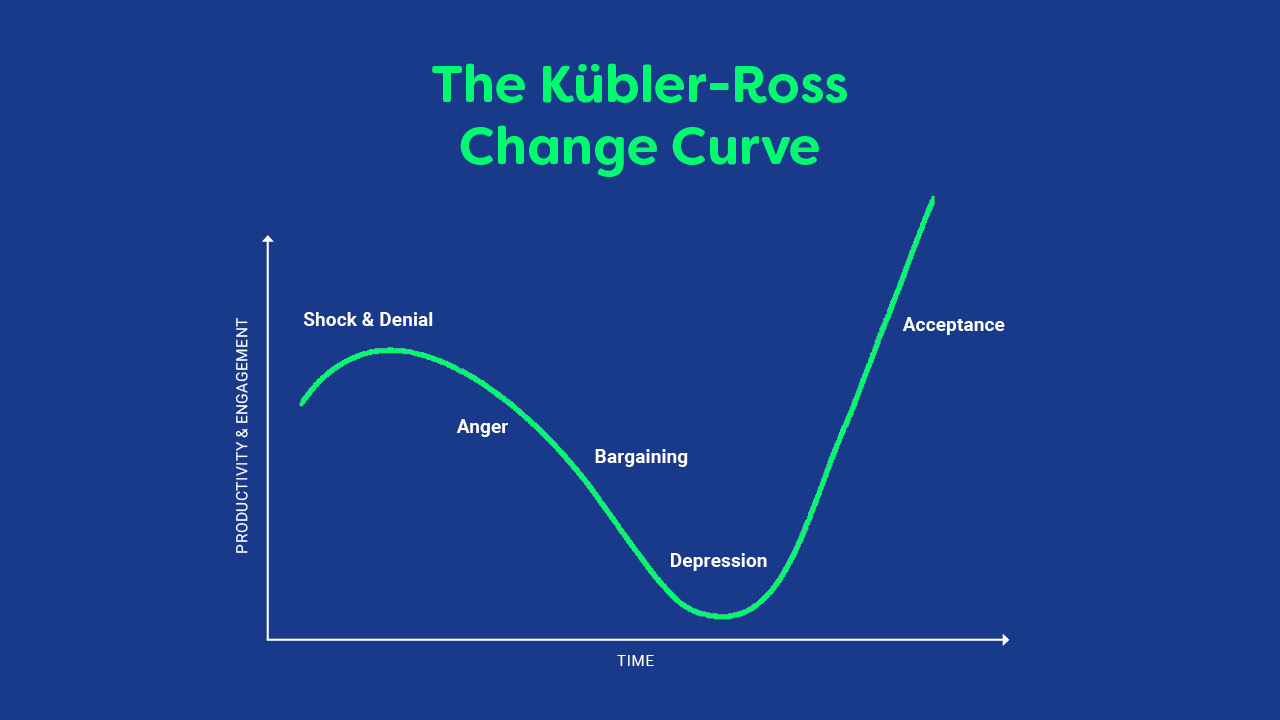

Clear communication and setting realistic expectations are key to overcoming these initial challenges. At KBS, we use the Kübler-Ross change curve to help explain how the benefits of the fraud detection system might evolve over time. While not a perfect analogy, it illustrates the journey of perceptions and benefits as they develop.

You can expect to encounter a period where results might seem underwhelming. It’s crucial to balance enthusiasm with a realistic outlook during the first few months after deployment. By setting clear expectations, you and your stakeholders will have a better understanding of the timeline for assessing the true benefits of the system.

Analyzing Effectiveness

Once there is a common understanding of the challenges in assessing benefits, we employ advanced analytical techniques such as cohort and survival analysis. These methods allow us to compare different detection and scoring regimes on a like-for-like basis, providing clear insights without over-complicating the process with statistics.

This analytical approach helps in making data-driven decisions, ensuring that you can effectively measure and understand the performance of the new fraud detection system compared to previous ones.

Leveraging Experience for Realistic Expectations

Our extensive experience in the insurance industry informs our approach to setting expectations. At KBS, we prioritise providing a realistic outlook on both the impact and timing of the benefits. Overselling immediate results can be detrimental, so we focus on delivering sustainable, long-term improvements.

The Pains and Gains

Throughout this journey, you will encounter both pains and gains. The initial phase might be challenging, with the time lag in realising benefits and the potential for misinterpretation of early results. However, with patience and a clear understanding of the process, these initial pains give way to significant gains.

The gains come in the form of more effective fraud detection, resulting in long-term savings, improved efficiency, and enhanced reputation for your company. By maintaining transparency and leveraging our expertise, we aim to provide solutions that deliver measurable benefits with minimal disruption and maximum impact.

Success in implementing fraud detection software is a journey that requires clear communication, realistic expectation-setting, and thorough analysis. By leveraging our expertise and maintaining transparency, KBS aims to provide effective fraud detection solutions that deliver measurable benefits over time, with minimal disruption and maximum results.